Top 5 Financial Mistakes Small Business Owners Make

…and How to Avoid Accounts Management Pitfalls

Running a creative business comes with a unique set of challenges and managing finances is often at the forefront. To economise, entrepreneurs and creatives often try to navigate the complex world of bookkeeping, budgets, and financial planning on their own. Unfortunately, mistakes in doing so can hinder the success of a project, or even impact an entire businesses.

Over the last five years at Neo Numerist, I’ve seen financials in complete disarray, underpaid workers, creative projects collapse, and even fraud that has occurred as a result of poor bookkeeping (mal)practices. So I’ve compiled a list of the Top 5 Mistakes I’ve repeatedly seen being made by small business owners, to help you avoid falling victim too.

Forgetting to budget for superannuation, holiday pay, Workcover, public holidays and other overheads

How to get it right

Budgeting is crucial in creative industries where projects often require substantial financial investments. Without a well-defined budget, it's easy to overspend on production costs, affecting the overall financial health of the venture. A production budget should be one of the first steps you take in your project along with consulting with a good production accountant for up-to-date cast and crew rates, super, holiday pay, work cover and other insurances

Neglecting cashflow in the creative process

How to get it right

Creativity doesn't guarantee immediate returns. It's essential for media, film, and TV professionals to manage cashflow effectively, ensuring they can sustain themselves and their projects during periods of creative development or project downtime. Most small businesses underestimate the amount they need to set aside for PAYG and GST - the easiest way to handle this is to transfer the GST on income to a savings account as soon as you receive it.

Overlooking tax planning

How to get it right

It is often too late to address things once the financial year has passed. For this reason it’s best to consult with your tax accountant in April or May to plan for an optimal financial position at June 30.

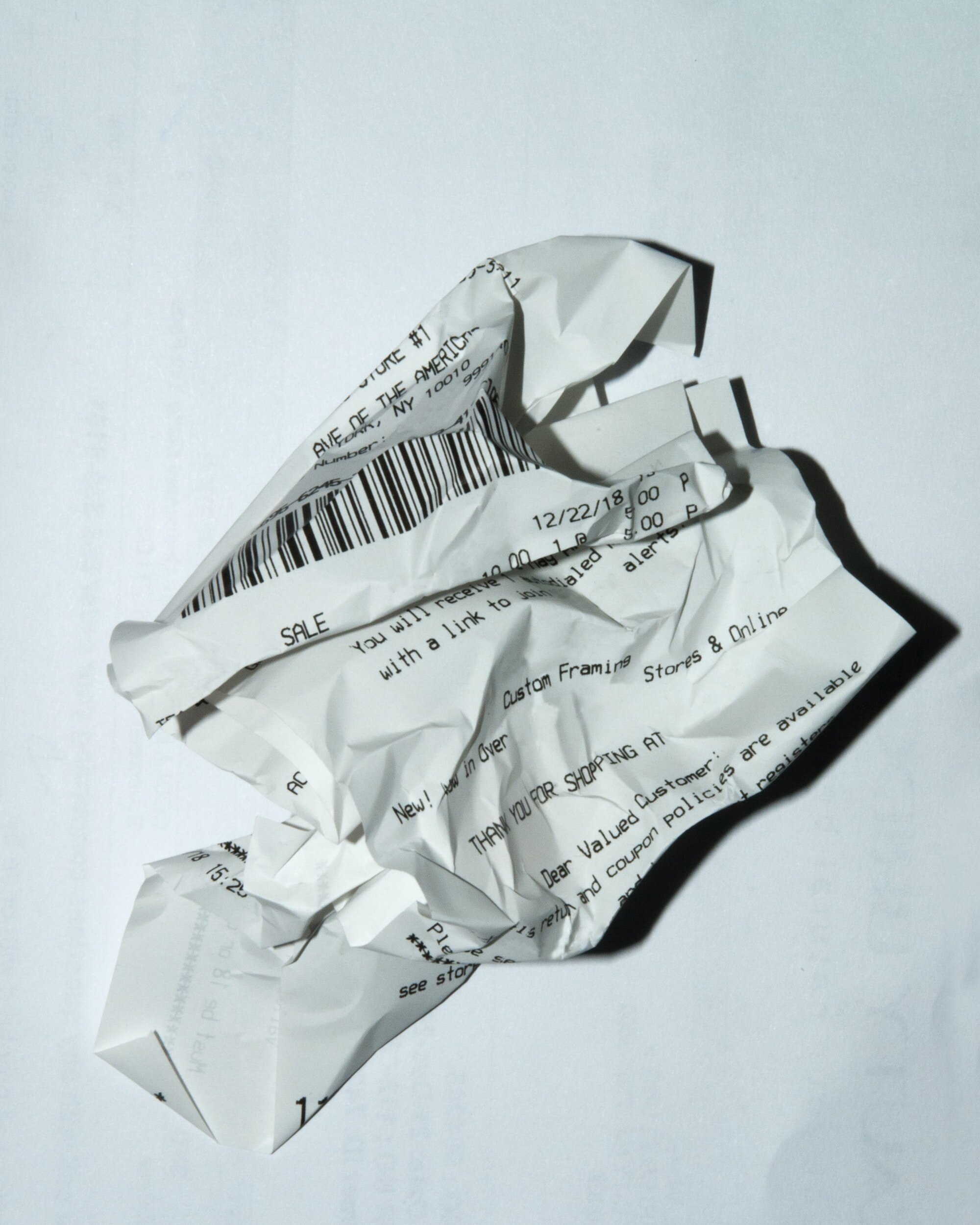

Disregarding documentation

How to get it right

Keeping records of expenses, from equipment purchases to location costs, is vital. Proper documentation not only helps in project tracking but is also essential for securing funding and proving financial transparency. I find many small business owners neglect to provide tax invoices for their GST registered contractors and therefore are missing out on GST credits, which can really add up!

Ignoring financial reports during financial decision-making

How to get it right

Financial reports aren't just for accountants; they're valuable tools when making creative decisions. Regularly reviewing budget variances, project profitability, and cash flow statements can empower media, film, and TV professionals to make informed creative and financial choices.

Consultation with an accounting professional before you start is the best way to go

As many creatives might prefer focusing on their craft, seeking relevant professional advice is crucial. Accountants and bookkeepers with experience in the film and TV industry, like the specialists at Neo Numerist, can provide tailored guidance to navigate the unique business challenges.

I trust that these will help you steer clear of these all-too-common errors in your work.

Of course, engaging a professional accountant is the best way to ensure financial stability, identify cost-savings, and maximise profits for your business.

We offer free phone consultations, so it’s worth giving us a holler discuss your business requirements. You’ll find more info below on how to get in touch.

Thanks for reading,

Holly

Author Holly Salmons is the founder of Neo Numerist. She holds a Master of Business (Bus. Law), University of Sydney and a Graduate Diploma in Producing & Screen Business, AFTRS.

Neo Numerist helps creatives make smarter accounting choices.

Founded and headed by me, Holly Salmons (M Bus.Law, Grad. Dip Screen) Neo Numerist provides cost-effective accounting to digital media creators and small businesses in the creative industries.

We specialise in accounting for film, television, and video production, along with other creative and digital industries.

We provide film and TV accounting services in Melbourne and Brisbane including pre pre-production finance consulting and last-minute cost reports. We can look after your bookkeeping and payroll for any production within Australia, and handle your BAS, budget and finance reviews, cashflow forecasting, and accounts payable. We even help launch start-ups and side hustles with the business essentials they need to start trading.

We can help you create a project budget and stick to it, identify cost-saving opportunities within your current projects, ensure you’re complying with regulations, facilitate positive relationships with investors and creditors, and offer valuable insights for informed decision-making.

We offer a range of Monthly Packages, from our Sole trader Starter Package to us working with you in-house or remotely in our Finance Manager Package. Alternatively, select your own suite of services to suit your needs.

Got questions? We’ve got answers.

Say HELLO today

We offer free consultations, so please contact us to book.

holly@neonumerist.com.au

+61 404 251 350